FAQ’s: Ohio’s Tax Holiday at Costume Holiday House

1. What and when is the sales tax holiday?

2. What items at Costume Holiday House qualify for the sales tax holiday?

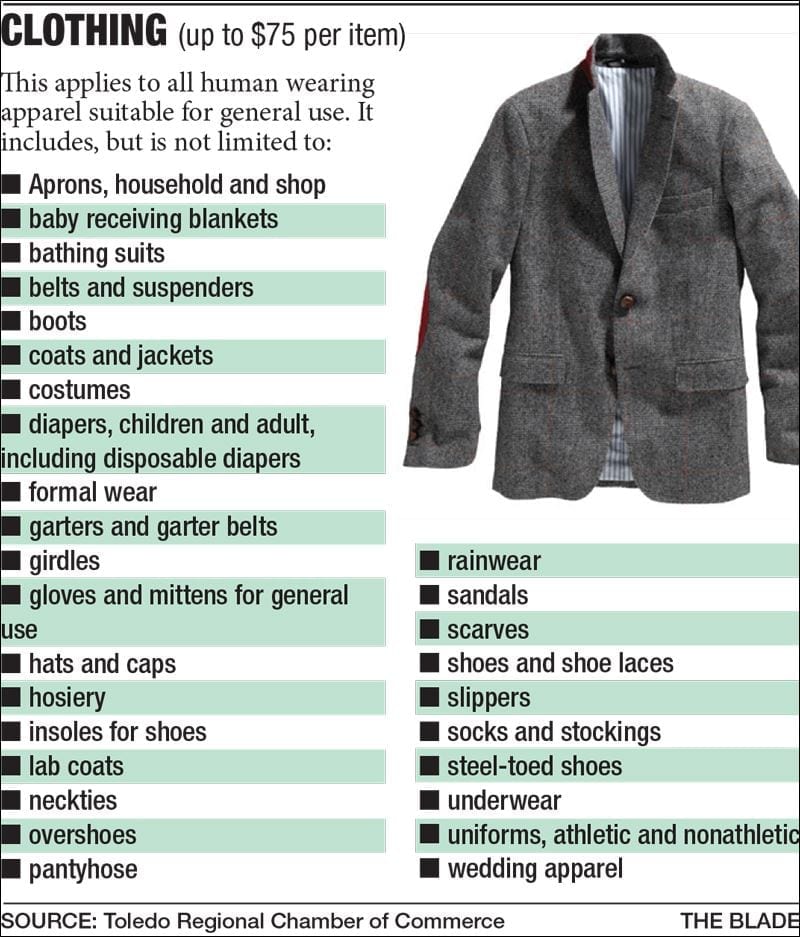

During the holiday, any item of clothing priced at $75 or less is exempt from sales and use tax.

3. What items do NOT qualify?

- Items purchased for use in a trade or business.

- Clothing accessories or equipment. Clothing accessories or equipment include: briefcases; cosmetics; hair notions, including, but not limited to, barrettes, hair bows, and hair nets; handbags; handkerchiefs; jewelry; sun glasses (non-prescription); umbrellas; wallets; watches; and wigs and hair pieces.

- Protective equipment. Protective equipment includes: breathing masks; clean room apparel and equipment; ear and hearing protectors; face shields; hard hats; helmets; paint or dust respirators; protective gloves; safety glasses and goggles; safety belts; tool belts; and welders gloves and masks.

- Sewing equipment and supplies including, but not limited to, knitting needles, patterns, pins, scissors, sewing machines, sewing needles, tape measures, and thimbles; and sewing materials that become part of “clothing†including, but not limited to, buttons, fabric, lace, thread, yarn, and zippers.

- Sports or recreational equipment. Sport or recreational equipment includes ballet and tap shoes; cleated or spiked athletic shoes; gloves, including, but not limited to, baseball, bowling, boxing, hockey, and golf; goggles; hand and elbow guards; life preservers and vests; mouth guards; roller and ice skates; shin guards; shoulder pads; ski boots; waders; and wetsuits and fins.

- Belt buckles sold separately.

- Costume masks sold separately.

- Patches and emblems sold separately.

4. Can I buy multiple items, if the total is more than $75?

5. If I have an item that is more than $75, is the first $75 exempt from taxes?

6. What about sets containing both exempt and taxable items?

7. How are coupons and discounts handled?

8. Does the exemption apply to repairs, alterations, or items for rent?

9. Does the exemption apply to telephone and internet orders?

10. Does the exemption apply to shipping and handling charges?

11. How should retailers handle exchanges and returns?

- If a consumer buys an eligible item during the sales tax holiday and later exchanges it for the same item in a different size or color, the retailer should not charge sales tax even if the exchange is made after the end of the sales tax holiday.

- If a consumer buys an eligible item during the sales tax holiday and returns the item after the tax holiday period for credit on the purchase of a different item, the retailer must charge sales tax on the sale of the newly purchased item, even if it would have been eligible for the exemption during the sales tax holiday.

- If a consumer buys an eligible item before the holiday period, but returns the item during the sales tax holiday period and receives credit on the purchase of a different item of eligible property, no sales tax is due on the sale of the new item. The retailer must provide the consumer credit for both the purchase price and sales tax paid on the item being returned.